Introduction

This document details the methodology for the Intracranial Hemorrhage or Cerebral Infarction measure and should be reviewed along with the Intracranial Hemorrhage or Cerebral Infarction Measure Codes List file, which contains the medical codes used in constructing the measure.

Measure Description

Episode-based cost measures represent the cost to Medicare for the items and services provided to a patient during an episode of care (“episode”). In all supplemental documentation, “cost” generally means the standardized Medicare allowed amount, which includes both Medicare and trust fund payments and any applicable beneficiary deductible and coinsurance amounts.

The Intracranial Hemorrhage or Cerebral Infarction episode-based cost measure evaluates a clinician’s risk-adjusted cost to Medicare for beneficiaries who receive inpatient treatment for cerebral infarction or intracranial hemorrhage during the performance period. The cost measure score is the clinician’s risk-adjusted cost for the episode group averaged across all episodes attributed to the clinician. This acute inpatient medical condition measure includes costs of services that are clinically related to the attributed clinician’s role in managing care during each episode from the clinical event that opens, or “triggers,” the episode through 90 days after the trigger.

Measure Rationale

Each year approximately 780,000 people in the United States suffer a new or recurring stroke, and strokes are the leading cause of permanent disability in adults and the third leading cause of death in the US. A 2010 study estimated that ischemic strokes alone were responsible for close to $65.5 billion in healthcare spending in the US because of the need for long-term care after a stroke.3 The Intracranial Hemorrhage or Cerebral Infarction episode-based cost measure was recommended for development by an expert clinician committee—the Neuropsychiatric Disease Management Clinical Subcommittee—because of its high impact in terms of patient population and Medicare spending, and the opportunity for incentivizing cost-effective, high-quality clinical care in this area. The Clinical Subcommittee provided extensive, detailed input on this measure.

Measure Numerator:

The cost measure numerator is the sum of the ratio of observed to expected4 payment-standardized cost to Medicare for all Intracranial Hemorrhage or Cerebral Infarction episodes attributed to a clinician. This sum is then multiplied by the national average observed episode cost to generate a dollar figure.

Measure Denominator:

The cost measure denominator is the total number of episodes from the Intracranial Hemorrhage or Cerebral Infarction episode group attributed to a clinician.

Data Sources:

The Intracranial Hemorrhage or Cerebral Infarction cost measure uses the following data sources:

- Medicare Parts A and B claims data from the Common Working File (CWF)

- Enrollment Data Base (EDB)

- Long Term Care Minimum Data Set (LTC MDS)

Care Settings:

Methodologically, the Intracranial Hemorrhage or Cerebral Infarction cost measure can be triggered based on claims data from the following settings: inpatient (IP) hospitals.

Cohort:

The cohort for this cost measure consists of patients who are Medicare beneficiaries enrolled in Medicare fee-for-service and who receive inpatient treatment for cerebral infarction or intracranial hemorrhage that triggers an Intracranial Hemorrhage or Cerebral Infarction episode.

The cohort for this cost measure is also further refined by the definition of the episode group and measure-specific exclusions (see Section 0).

Overview of Measure Methodology

There are two overarching processes in calculating episode-based cost measure scores: episode construction (Steps 1-3) and measure calculation (Steps 4-6). This section provides a brief one-page summary of these processes for the Routine Cataract Removal with IOL Implantation cost measure, and Section 0 describes the processes in more detail.

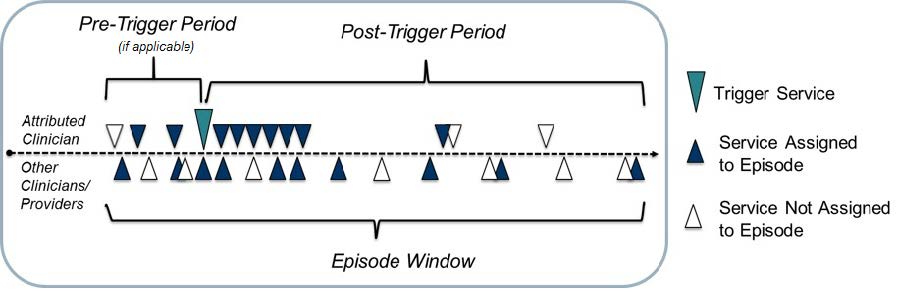

- Trigger and define an episode: Episodes are defined by billing codes that open, or “trigger,” an episode. The episode window starts 60 days before the trigger and ends 90 days after the trigger. To enable meaningful clinical comparisons, episodes are placed into more granular, mutually exclusive sub-groups based on clinical criteria. Some episodes may also be excluded based on other information available at the time of the trigger.

- Attribute the episode to a clinician: For this procedural episode group, an attributed clinician is any clinician who bills a trigger code for the episode group on the day of the procedure.

- Assign costs to the episode and calculate the episode observed cost: Clinically related services occurring during the episode window are assigned to the episode. The cost of the assigned services is summed to determine each episode’s standardized observed cost.

- Exclude episodes: Exclusions remove unique groups of patients from cost measure calculation in cases where it may be impractical and unfair to compare the costs of caring for these patients to the costs of caring for the cohort at large.

- Calculate expected costs for risk adjustment: Risk adjustment aims to isolate variation in clinician costs to only the costs that clinicians can reasonably influence (e.g., accounting for beneficiary age, comorbidities and other factors). A regression is run using the risk adjustment variables as covariates to estimate the expected cost of each episode. Then, statistical techniques are applied to reduce the effect of extreme outliers on measure scores.

- Calculate the measure score: For each episode, the ratio of standardized total observed cost (from step 3) to risk-adjusted expected cost (from step 5) is calculated and averaged across all of a clinician or clinician group’s attributed episodes to obtain the average episode cost ratio. The average episode cost ratio is multiplied by the national average observed episode cost to generate a dollar figure for the cost measure score.

Detailed Measure Methodology

This section details the two overarching processes in calculating episode-based cost measure scores in more detail: Sections 0 through 0 describe episode construction and Sections 0 through 0 describe measure calculation.

Trigger and Define an Episode

Intracranial Hemorrhage or Cerebral Infarction episodes are defined by medical Medicare Severity Diagnosis-Related Group (MS-DRG) codes that open, or trigger, an episode. Specifically, episodes are triggered by the occurrence of IP E&M codes on Part B Physician/Supplier claims during an IP facility stay with a specified MS-DRG. For the codes and logic relevant to this section please see the “Triggers” and “Trigger_Exclusions” tabs of the Intracranial Hemorrhage or Cerebral Infarction Measure Codes List.

The steps for defining an episode for the Intracranial Hemorrhage or Cerebral Infarction episode group are as follows:

- Identify Part B Physician/Supplier claim lines with positive standardized payment that meet the following conditions:

- They have a relevant inpatient Current Procedural Terminology / Healthcare Common Procedure Coding System (CPT/HCPCS) E&M code as listed in the “Attribution” tab of the Intracranial Hemorrhage or Cerebral Infarction Measure Codes List file.

- They were billed by a clinician of a specialty that is eligible for MIPS.

- Identify IP stays with positive standardized payment that have a trigger code specified in the “Triggers” tab of the Intracranial Hemorrhage or Cerebral Infarction Measure Codes List file.

- Trigger an episode for an identified IP stay if at least one identified Part B Physician/Supplier claim line has an expense date concurrent to the IP stay.

- Establish the episode window as follows:

- Establish the episode trigger date as the IP stay admission date.

- Establish the episode start date as the episode trigger date.

- Establish the episode end date as 90 days after the episode trigger date.

- Define trigger exclusions based on information available at the time of the trigger, if applicable.

Once an Intracranial Hemorrhage or Cerebral Infarction episode is triggered, the episode is placed into one of the episode sub-groups to enable meaningful clinical comparisons. Sub-groups represent more granular, mutually exclusive patient populations defined by clinical criteria (e.g., information available on the beneficiary’s claims at the time of the trigger). Sub-groups are useful in ensuring clinical comparability so that the corresponding cost measure fairly compares clinicians with a similar patient case-mix.

Codes used to define the sub-groups can be found in the “Sub_Groups” tab of the Intracranial Hemorrhage or Cerebral Infarction Measure Codes List file. This cost measure has two sub-groups:

- Intracerebral or Subdural Hemorrhage

- Cerebral Infarction

Attribute Episodes to a Clinician

Once an episode has been triggered and defined, it is attributed to one or more clinicians of a specialty that is eligible for MIPS. Clinicians are identified by Taxpayer Identification Number (TIN) and National Provider Identifier (NPI) pairs (TIN-NPI), and clinician groups are identified by TIN. Only clinicians of a specialty that is eligible for MIPS or clinician groups where the triggering clinician is of a specialty that is eligible for MIPS are attributed episodes. For codes relevant to this section, please see the “Attribution” tab of the Intracranial Hemorrhage or Cerebral Infarction Measure Codes List. For an example of how attribution works for acute inpatient medical condition episodes, please refer to Appendix B.

The steps for attributing an Intracranial Hemorrhage or Cerebral Infarction episode are as follows:

- Identify Part B Physician/Supplier claim lines for which all of the following conditions are true:

- They have an expense date concurrent to the trigger IP stay.

- They have a CPT/HCPCS code included in the list of IP E&M codes for TIN-NPI attribution.

- Attribute an episode to a TIN if that TIN billed at least 30 percent of the IP E&M codes on identified Part B Physician/Supplier claim lines during the trigger IP stay.

- Attribute the episode to a TIN-NPI if a clinician within an attributed TIN billed any IP E&M codes on identified Part B Physician/Supplier claim lines during the trigger IP stay.

Future attribution rules may benefit from the implementation of patient relationship category codes. CMS will consider how to incorporate the patient relationship categories into episode-based cost measurement methodology as clinicians and billing experts gain experience with them.

Assign Costs of Services to an Episode and Calculate Total Observed Episode Cost

Services, and their Medicare costs, are assigned to an episode only when clinically related to the attributed clinician’s role in managing patient care during the episode. Assigned services may include treatment and diagnostic services, ancillary items, services directly related to treatment, and those furnished as a consequence of care (e.g., complications, readmissions, unplanned care, and emergency department visits). Unrelated services are not assigned to the episode. For example, the cost of care for a chronic condition that occurs during the episode but not related to the clinical management of the patient relative to the inpatient treatment for cerebral infarction or intracranial hemorrhage would not be assigned.

To ensure that only clinically related services are included, services during the episode window are assigned to the episode based on a series of service assignment rules, which are listed in the “SA_[Pre/Post]_[Service_Category]” tabs of the Intracranial Hemorrhage or Cerebral Infarction Measure Codes List file.

For the Intracranial Hemorrhage or Cerebral Infarction episode group, only services performed in the following service categories are considered for assignment to the episode costs:

- Emergency Department (ED)

- Outpatient (OP) Facility and Clinician Services

- Long Term Care Hospital (LTCH) – Medical

- LTCH – Surgical

- IP – Medical

- IP – Surgical

- Inpatient Rehabilitation Facility (IRF) – Medical

- Durable Medical Equipment, Prosthetics, Orthotics, and Supplies (DME)

- Home Health (HH)

As an overview, service assignment rules may be modified based on the service category in which the service is performed, as listed above. Service assignment rules may also vary based on (i) additional criteria determined by other diagnosis, procedure, or billing codes appearing alongside the service code, or (ii) the specific timing of the service. Services may be assigned to the episode based on the following additional criteria:

- Services may be assigned to the episode based on the following additional criteria:

- Service code alone

- Service code in combination with other diagnosis, procedure, or billing codes such as:

- The first three digits of the International Classification of Diseases – Tenth Revision diagnosis code (3-digit ICD-10 DGN)

- The full ICD-10 DGN

- Additional service information

- Services may be assigned only with specific timing:

- Services may be assigned based on whether or not the service and/or diagnosis is newly occurring

- Services may be assigned only if they occur within a particular number of days from the trigger within the episode window, and services may be assigned for a period shorter than the full duration of the episode window.

The steps for assigning costs are as follows:

- Identify all services on claims with positive standardized payment that occur within the episode window.

- Assign identified services to the episode based on the types of service assignment rules described above.

- Assign skilled nursing facility (SNF) claims based on the following:

- Identify SNF claims for which both (i) the SNF claim’s qualifying IP stay is the IP stay during which the trigger occurs and (ii) the SNF claim occurs during the episode window.

- For those identified SNF claims, assign the percentage of the claim amount proportional to the portion of the SNF claim that overlaps with the episode window.

- Sum standardized Medicare allowed amounts for all claims assigned to each episode to obtain the standardized total observed episode cost.

Service Assignment Example

- This example is for the Routine Cataract Removal with IOL Implantation cost measure. It is provided here to illustrate how service assignment works, as this framework applies to all episode-based cost measures.

- Clinician A performs surgical treatment for routine cataract removal with an intraocular lens (IOL) implantation for Patient K on January 2, 2019. This service triggers a Routine Cataract Removal with IOL Implantation episode, which is attributed to Clinician A.

- Clinician B performs a lens repositioning procedure, which is considered a clinically related service, during the episode window on January 11, 2019.

- Because lens repositioning is considered to be clinically related to the surgical treatment for routine cataract removal with IOL implantation, the cost of the repositioning procedure will be assigned to Clinician A’s Routine Cataract Removal with IOL Implantation episode.

Exclude Episodes

Before measure calculation, episode exclusions are applied to remove certain episodes from measure score calculation. Certain exclusions are applied across all acute inpatient medical condition episode groups to ensure that each episode has complete data available for measure calculation, and other exclusions are specific to this measure, based on consideration of the clinical characteristics of a homogenous patient cohort. The measure-specific exclusions are listed in the “Exclusions” and “Exclusions_Details” tabs in the Intracranial Hemorrhage or Cerebral Infarction Measure Codes List file.

The steps for episode exclusion are as follows:

- Exclude episodes from measure calculation if:

- The beneficiary has a primary payer other than Medicare for any time overlapping the episode window or 120-day lookback period prior to the trigger day.

- The beneficiary was not enrolled in Medicare Parts A and B for the entirety of the lookback period plus episode window, or was enrolled in Part C for any part of the lookback plus episode window.

- No TIN is attributed the episode.

- The beneficiary’s date of birth is missing.

- The beneficiary’s death date occurred before the episode ended.

- The trigger IP stay has the same admission date as another IP stay.

- The IP facility is not a short-term stay acute hospital as defined by subsection (d).

- Apply measure-specific exclusions, which check the beneficiary’s Medicare claims history for certain billing codes (as specified in the Measure Codes List file) that indicate the presence of a particular procedure, condition, or characteristic.

Estimate Expected Costs through Risk Adjustment

Risk adjustment is used to estimate expected episode costs in recognition of the different levels of care beneficiaries may require due to comorbidities, disability, age, and other risk factors. The risk adjustment model includes variables from the CMS Hierarchical Condition Category Version 22 (CMS-HCC V22) 2016 Risk Adjustment Model,6 as well as other standard risk adjustors (e.g., beneficiary age) and variables for clinical factors that may be outside the attributed clinician’s reasonable influence. A full list of risk adjustment variables can be found in the “RA_Vars” and “RA_Vars_Details” tabs of the Intracranial Hemorrhage or Cerebral Infarction Measure Codes List file.

Steps for defining risk adjustment variables and estimating the risk adjustment model are as follows:

- Define HCC and episode group-specific risk adjustors using service and diagnosis information found on the beneficiary’s Medicare claims history in the 120-day period prior to the episode trigger day (or the timing specified in the “RA_Vars_Details” tab of the Measure Codes List file) for certain billing codes that indicate the presence of a procedure, condition, or characteristic.

- Define other risk adjustors that rely upon Medicare beneficiary enrollment and assessment data as follows:

- Identify beneficiaries who are originally “Disabled without end-stage renal disease (ESRD)” or “Disabled with ESRD” using the original reason for joining Medicare field in the Medicare beneficiary enrollment database.

- Identify beneficiaries with ESRD if their enrollment indicates ESRD coverage, ESRD dialysis, or kidney transplant in the Medicare beneficiary enrollment database in the lookback period.

- Identify beneficiaries who have spent at least 90 days in a long-term care institution without having been discharged to the community for 14 days, based on MDS assessment data.

- Drop risk adjustors that are defined for less than 15 episodes nationally for each sub-group to avoid using very small samples.

- Categorize beneficiaries into age ranges using their date of birth information in the Medicare beneficiary enrollment database. If an age range has a cell count less than 15, collapse this with the next adjacent higher age range category.

- Include the MS-DRG of the episode’s trigger IP stay as a categorical risk adjustor.

- Run an ordinary least squares (OLS) regression model to estimate the relationship between all the risk adjustment variables and the dependent variable, the standardized observed episode cost, to obtain the risk-adjusted expected episode cost. A separate OLS regression is run for each episode sub-group nationally.

- Winsorize expected costs as follows.

- Assign the value of the 0.5th percentile to all expected episode costs below the 0.5th percentile.

- Renormalize values by multiplying each episode’s winsorized expected cost by the sub-group’s average expected cost, and dividing the resultant value by the sub-group’s average winsorized expected cost.

- Exclude episodes with outliers as follows. This step is performed separately for each sub-group.

- Calculate each episode’s residual as the difference between the re-normalized, winsorized expected cost computed above and the observed cost.

- Exclude episodes with residuals below the 1st percentile or above the 99th percentile of the residual distribution.

- Renormalize the resultant expected cost values by multiplying each episode’s winsorized expected costs after excluding outliers by the sub-group’s average standardized observed cost across all episodes originally in the risk adjustment model, and dividing by the sub-group’s average winsorized expected cost after excluding outliers.

Calculate Measure Scores

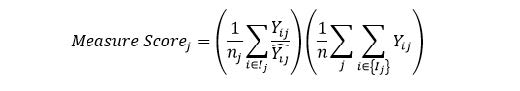

Measure scores are calculated for a TIN or TIN-NPI as follows:

- Calculate the ratio of observed to expected episode cost for each episode attributed to the clinician/clinician group.

- Calculate the average ratio of observed to expected episode cost across the total number of

episodes attributed to the clinician/clinician group. - Multiply the average ratio of observed to expected episode cost by the national average

observed episode cost to generate a dollar figure representing risk-adjusted average episode

cost.

The clinician-level or clinician group practice-level risk-adjusted cost for any attributed clinician (or clinician group practice) “j” can be represented mathematically as:

where:

| ??? | is the standardized payment for episode i and attributed clinician (or clinician group practice) j |

| ? ?? | is the expected standardized payment for episode i and clinician (or clinician group practice) j, as predicted from risk adjustment |

| ?? | is the number of episodes for clinician (or clinician group practice) j |

| ? | is the total number of TIN/TIN-NPI attributed episodes nationally |

| is all episodes i in the set of episodes attributed to clinician (or clinician group practice) j |

Appendix A. How to Use the Measure Codes List File

The Measure Codes List file is an Excel workbook that provides clinicians with the specific codes and logic that apply to this cost measure. It is intended to be reviewed along with the detailed measure methodology in Section 0.

Overview

The “Overview” tab provides introductory information on the measure, a Table of Contents with descriptions of and links to the tabs in the workbook, and a Key Terms and Acronyms section that introduces acronyms used throughout the file. Each tab has a hyperlink in the top right corner to proceed to the next tab and in the top left corner to return to the “Overview” tab.

Trigger and Define an Episode

The following tabs present the codes and logic that define an episode of the episode group, as well as those that specify the sub-groups that comprise the episode group if applicable, as described in Section 0.

- “Triggers” lists all of the codes which trigger (or open) the episode group, along with the logic accompanying those triggers.

- If applicable, “Trigger_Exclusions” lists codes that will cause the episode not to be triggered if they occur in conjunction with the trigger codes.

- If applicable, “Sub_Groups” contains all of the sub-groups for the episode group, as well as the codes and logic used to specify each sub-group.

Clinician Attribution

The “Attribution” tab presents the codes that aid in attributing episodes to clinicians, as described in Section 0.

Service Assignment

The service assignment (SA) tabs, with tab names containing the “SA” prefix, present the service assignment codes and logic for different service categories during either the pre-trigger period or the post-trigger period. These codes and logic determine services for which costs are assigned to an episode, as described in Section 0.

- “SA_Pre_[Service_Category]” tabs indicate services assigned in the pre-trigger period for various service categories/settings.

- “SA_Post_[Service_Category]” tabs indicate services assigned in the post-trigger period for various service categories/settings.

Risk Adjustment and Exclusions

The following tabs present the variables used during measure calculation to ensure that clinician performance is being compared on a like-to-like basis, as described in Sections 0 and 0.

- “RA_Vars” contains the risk adjustment variables used in the construction of the measure’s risk adjustment model, including variables used in the risk adjustment model for all episode-based cost measures and any measure-specific variables (if applicable).

- If applicable, “RA_Vars_Details” provides more detail on the risk adjustment variables that are specific to this measure.

- If applicable, “Exclusions” contains a list of measure-specific variables that indicate that an episode is not clinically comparable. If these variables are present in an episode, that episode will not be included in measure score calculation.

- If applicable, “Exclusions_Details” provides additional information on measure-specific exclusion variables, including the codes and logic used to define the variables.

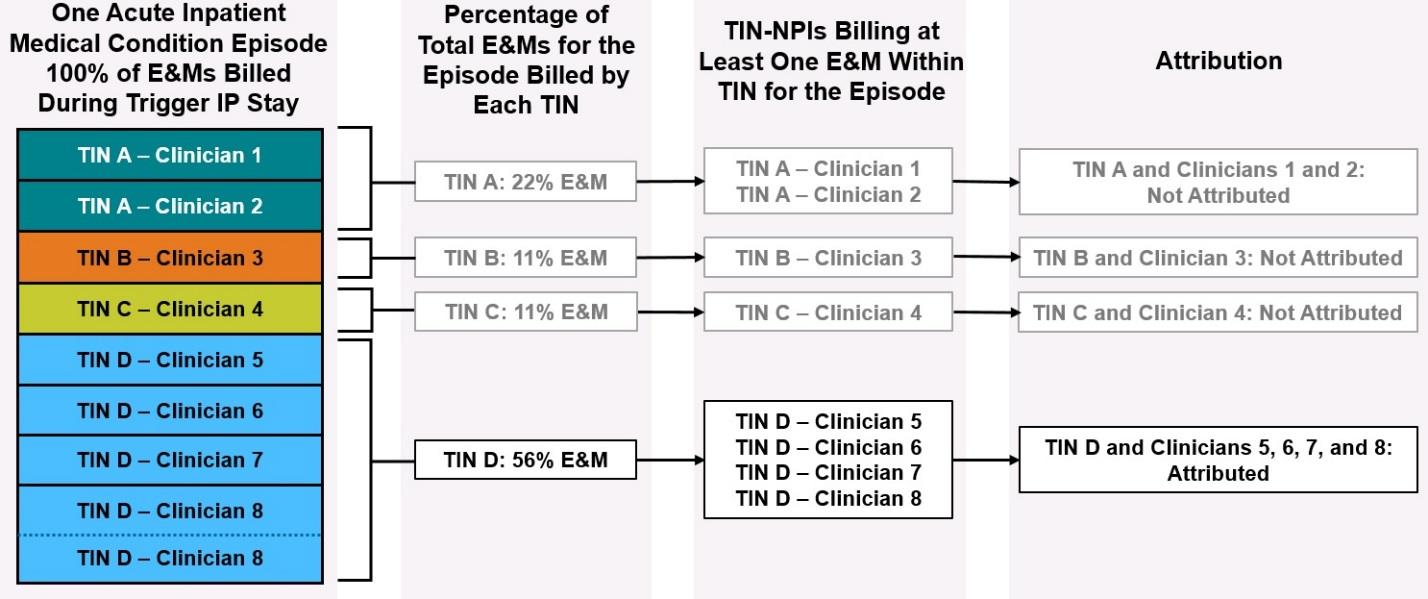

Appendix B. Example of Attribution for Acute Inpatient Medical Condition Episodes

This appendix provides some further details and an example of attribution for acute inpatient medical condition episodes. An episode is attributed to a:

- TIN if that TIN billed at least 30 percent of the IP E&M codes on identified Part B Physician/Supplier claim lines during the trigger IP stay, and to a

- TIN-NPI if a clinician within an attributed TIN billed any IP E&M codes on identified Part B Physician/Supplier claim lines during the trigger IP stay.

In the example shown above, the stacked, colored boxes on the left represent E&Ms billed by eight different TIN-NPIs (Clinicians 1 through 8) across four TINs (TINs A through D) during the trigger IP stay for one acute inpatient medical condition episode. Clinicians 1 through 7 each billed one E&M claim each under their respective TINs, and Clinician 8 billed two E&M claims under TIN D. The next set of boxes to the right of the colored boxes show the percentage of total E&Ms for that trigger IP stay that were billed by each of the four TINs. Moving right, the next set of boxes list the clinicians within each of the four TINs who billed at least one E&M during the trigger IP stay. Finally, the diagram shows a summary of how this affects attribution.

In this example, only TIN D billed at least 30 percent of the IP E&M codes during the trigger IP stay. This means:

- At the TIN level, only TIN D is attributed this episode.

- TINs A, B, and C did not meet the 30% threshold, so they are not attributed this episode.

- At the TIN-NPI level, each TIN-NPI (Clinicians 5, 6, 7, and 8) billing at least one E&M within TIN D is attributed this episode.

TINs A, B, and C did not meet the 30% threshold, so the TIN-NPIs billing within them (Clinicians 1, 2, 3, and 4) are not attributed this episode.

Appendix C. Example of Measure Calculation

- Calculate the observed cost of each episode by summing all standardized allowed amounts for services assigned to episode cost.

- Calculate the expected cost of each episode by running a risk adjustment model that includes only episodes within the same sub-group nationally.

- For measures with sub-groups, this ensures that expected cost for an episode in an intrinsically lower cost sub-group is estimated separately from the expected cost for an episode in an intrinsically higher cost sub-group.

- If a measure does not have sub-groups, the model includes all episodes within the episode group nationally.

- Divide each episode’s observed cost by the expected cost to obtain the observed to expected cost ratio for each episode.

- If the observed to expected cost ratio is greater than 1, this indicates that the episode’s observed cost was greater than expected for the care provided for the particular patients and episodes included in the calculation. A ratio less than 1 indicates that the observed cost was less than expected for the care provided for the particular patients and episodes included in the calculation.

- For example, if an episode’s observed cost is $5,000, and the expected cost for the episode is $3,000, then the ratio will be $5,000/$3,000 = 1.67, which would indicate that the episode cost is greater than expected.

- If an episode’s observed cost is $3,000, and the expected cost for the episode is $5,000, the ratio would be 0.6, which would indicate that the episode cost is less than expected.

- Sum the observed/expected ratios for all episodes across the entire episode group (i.e., across all sub-groups for applicable measures) and divide by the total number of episodes across the episode group to get